Quantum Leaps & On-Chain Realities: A Week Packed with Game-Changing Innovations.

👋 Hello, Visionaries!

Did you know that the global blockchain technology market size is expected to reach $39.7 billion by 2025, growing at a CAGR of 67.3% from 2020 to 2025? (Source: MarketsandMarkets™) If that doesn't scream "future," I don't know what does. But hold onto your seats because this week's newsletter is packed with stories that make that statistic look like child's play.

🔗 First up, we're diving into JPMorgan's ground breaking blockchain collateral settlement in a BlackRock and Barclays trade. If you've ever wondered how blockchain revolutionises traditional finance, you won't want to miss this.

🔮 Next, we'll explore IonQ's latest unveiling: rack-mounted quantum computers that are plug-and-play for any data centre. Yes, you read that right—quantum computing is no longer just a buzzword; it's a reality.

💳 On the financial frontier, Mastercard is making waves down under with its interoperable Central Bank Digital Currency (CBDC) in Australia. Could this be the future of global transactions? We'll delve into the nitty-gritty.

🇨🇳 And speaking of CBDC revolutions, China's FX regulator believes that CBDC features could significantly improve monetary policy. We'll unpack what this means for the global economy.

🤖 AI enthusiasts, brace yourselves. We're going to dissect Microsoft's new AI model, ORCA. If you're keen on understanding the next big thing in artificial intelligence, this is your stop.

🏥 In healthcare, we'll look at a ground-breaking 3D printing technique that's set to revolutionise medical treatments. Plus, we'll examine why Europe has been leading the 3D printing boom over the last decade.

🏛️ Last but not least, we'll take a virtual tour of the Acropolis as the ancient Greeks knew it, thanks to a new augmented reality app. Because who says you can't mix a little history with your tech?

So grab your favourite cup of joe ☕, sit back, and let's journey through the future, today.

To infinity and beyond! 🚀

JPMorgan Debuts Blockchain Collateral Settlement in BlackRock-Barclays Trade

Ever heard the saying, "Time is money"? Well, JPMorgan Chase & Co. is taking that quite literally. They've just gone live with their first-ever collateral settlement using blockchain technology, and it's a game-changer. According to a recent article by Anna Irrera on Bloomberg, JPMorgan's Tokenized Collateral Network (TCN) was used by BlackRock to convert shares in one of its money market funds into digital tokens. These tokens were transferred to Barclays as collateral for an over-the-counter derivatives trade. Talk about a digital handshake! 🤝

Why This Matters

This isn't just a one-off experiment; it's a significant step towards commercialising blockchain in the financial sector. The collateral moved almost instantaneously, compared to the traditional day-long process. Imagine the efficiency gains! We're talking about freeing up locked capital to use in ongoing transactions. It's like turning your closet of unused gadgets into a treasure trove of investment opportunities. 🏦

The Bigger Picture

Critics have often questioned blockchain's utility in finance, but this move shows that the technology has real, tangible benefits. JPMorgan aims to expand the range of assets that can be used as collateral, including equities and fixed income. So, it's not just about speed but flexibility and scalability.

Food for Thought

What regulatory changes might we see as blockchain becomes more mainstream?

How can you, as an investor or financial enthusiast, leverage these advancements?

IonQ Unveils Rack-Mounted Quantum Computers: Plug and Play for Any Data Centre

Alright, let's keep this tech train rolling! Just when you thought JPMorgan's blockchain move was the pinnacle of innovation, here comes IonQ, making quantum computing as easy as setting up a new gaming console. According to an article by Edd Gent on IEEE Spectrum, IonQ has unveiled designs for two new enterprise-grade quantum computers that will fit into standard server racks. Yes, you heard that right—no more dedicating an entire room to house a quantum computer. These babies can slot right into any data centre.

The Quantum Leap

IonQ's new devices are based on trapped-ion technology and are designed to integrate seamlessly with conventional computing infrastructure. Trapped-ion technology is a method used in the field of quantum computing to isolate and manipulate ions for the purpose of computation. In this approach, individual ions are trapped using electromagnetic fields in a vacuum chamber. These ions serve as quantum bits, or "qubits," which are the fundamental units of quantum information.

The Forte Enterprise, available next year, will feature 35 algorithmic qubits. That's a modest bump from their existing 29-qubit Forte computer, but here's the kicker: it will fit into just eight server cabinets, a 40% reduction in size. And by 2025, they plan to launch the 64-qubit Tempo, which they claim will outperform classical computers on specific tasks.

The Business Angle

This isn't just a tech marvel; it's a business strategy. IonQ is shifting from selling remote access to its devices over the cloud to actual hardware sales. CEO Peter Chapman emphasises that they're not just building high-performance machines but also aiming to make quantum computing more affordable and accessible.

Questions to Mull Over

How will this shift in business model impact IonQ's revenue streams?

What are the potential applications of these rack-mounted quantum computers in real-time data analysis or logistics?

As quantum computing becomes more accessible, what kind of ripple effect can we expect in industries like finance, healthcare, and beyond?

Mastercard Unveils Interoperable CBDC in Australia: A Game-Changer for Web3 Commerce

Now, fasten your seatbelts because we're about to take a detour Down Under! 🦘 Mastercard, in collaboration with the Reserve Bank of Australia and the Digital Finance Cooperative Research Centre, has just pulled the curtain back on a ground-breaking solution for Central Bank Digital Currencies. According to an article by Zach Anderson on Blockchain News, this isn't just another CBDC project; it's a pioneering venture that aims to make CBDCs interoperable across various blockchain networks.

The Aussie Innovation

Here's the magic: Mastercard's technology allows CBDCs to be tokenised or "wrapped" onto different blockchains. Imagine using your digital dollars on Ethereum, Binance Smart Chain, or any other blockchain platform you fancy. It's like having a universal remote for all your smart home devices! 🎮

The Web3 Connection

This initiative is more than just a tech marvel; it's a strategic move to bolster Web3 commerce both within Australia and globally. A live demo even showcased a holder of a pilot CBDC purchasing a non-fungible token (NFT) listed on the Ethereum public blockchain. Talk about a marriage between traditional finance and the decentralised world!

Questions to Chew On

What does this mean for the future of CBDCs globally? Could we see more countries adopting a similar approach?

How will this interoperability affect the broader crypto market and blockchain ecosystems?

Could this be the key to mass adoption of digital currencies and Web3 technologies?

China FX Regulator Says CBDC Features Could Improve Monetary Policy: A Tale of Two CBDCs

Let's connect the dots, shall we? 🌏 If you thought Australia was the lone ranger in the Asia-Pacific region exploring the CBDC frontier, think again! China is also splashing around in the CBDC pool, but they're doing the backstroke while Australia is freestyling. According to a Reuters article, China's foreign exchange regulator is eyeing programmable features in Central Bank Digital Currencies (CBDCs) as a game-changer for monetary policy. It's like Australia is building a Swiss Army knife of digital currencies, while China is crafting a specialised, laser-focused tool. 🛠️

The Chinese Perspective

While Mastercard is focusing on interoperability, China is looking at programmability. Lu Lei, Deputy Administrator of the State Administration of Foreign Exchange (SAFE), mentioned that central banks could make CBDCs M2 currency, which includes some deposits and savings, based on its programmable features.

The Global Implications

China's CBDC, the eCNY, already hit 18 trillion yuan ($2.49 trillion) in circulation at the end of June. With China exploring programmable features to adjust rates of CBDC, it could also be used to manage the macro economy.

Thinking Through

What are the global implications if China successfully implements programmable features in its CBDC?

Could programmable CBDCs be the future of monetary policy, and how might they interact with interoperable CBDCs like what Mastercard is developing?

All You Need to Know About ORCA, Microsoft's New AI Model: A Glimpse into the Future of AI

Next up, tech aficionados, let's switch gears from blockchain and quantum computing to something that's equally buzzworthy—artificial intelligence. Microsoft, in partnership with OpenAI, has recently unveiled ORCA, a new AI language model that's turning heads in the tech community. According to an article by Aasma Khan on YourStory, ORCA is designed to imitate the reasoning processes of large foundation models like GPT-4, but here's the kicker—it does so without requiring massive computing resources.

The ORCA Advantage

So, what's the big deal about ORCA? Well, it's like the Swiss Army knife of AI models. It can be optimised for specific tasks and trained using large language models. Despite its smaller size, ORCA is said to be on par with its bigger siblings, like GPT-4, in terms of performance. It's like having the power of a supercomputer in the palm of your hand—or, in this case, on your server rack.

The Competitive Edge

Ever since Microsoft revealed ORCA, it has sparked debates among users about whether it would compete with OpenAI's popular AI product, ChatGPT. Research shows that ORCA is capable of learning explanations, step-by-step thought processes, and other complex instructions. It's like having a personal tutor who can also help you ace your SATs, LSATs, GREs, and GMATs. Talk about a double threat!

Questions to Consider

How will ORCA's introduction impact the existing AI market and the use of large foundation models?

What are the potential applications of ORCA in various industries, given its lower computational requirements?

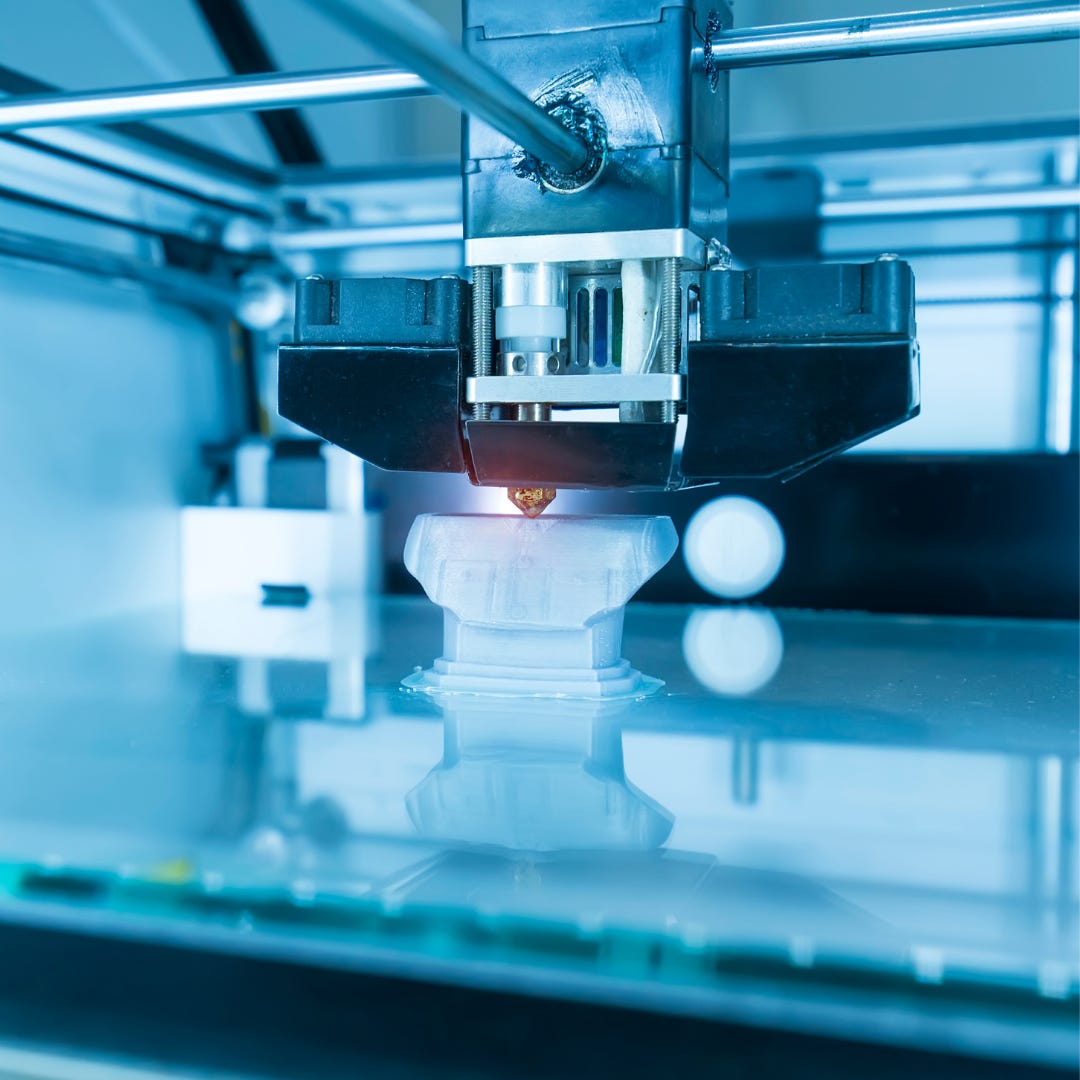

Revolutionizing Brain Health: Oxford's Neural 3D Printing Technique Unveils New Horizons in Medical Technology

Time to talk about something that's straight out of a sci-fi movie but is very much a reality today. According to a recent article on Yahoo Finance, researchers at the University of Oxford have made a an incredible discovery that could revolutionize treatments for brain injury patients. They've developed a neural 3D printing technique that simulates the architecture of the cerebral cortex. This is not just a leap; it's a quantum leap in medical technology!

The Future is 3D Printed

The Oxford team's research, published in Nature Communications, highlights the growing importance of 3D printing in healthcare. The global revenue for 3D printing in healthcare is expected to exceed $37 billion in 2023, with projections indicating significant growth up to 2033. Imagine the possibilities: personalised treatments, cost-effective medical devices, and much more. It's like having a medical lab right at your fingertips!

Cost-Effectiveness Meets Innovation

One of the most intriguing aspects of 3D printing in healthcare is its potential to cut costs. Traditional medical manufacturing can be a money pit, with labour-intensive procedures and complex supply chains. 3D printing sidesteps these issues, enabling rapid prototyping and on-demand production.

Europe at the Forefront of 3D Printing Boom Over the Last Decade: A Revolution in the Making

Following the University of Oxford's quantum leap in neural 3D printing, it's fascinating to note that Europe is not just a participant but a leader in this transformative tech. Citing an article by Luke Hurst on Euronews, the European Patent Office (EPO) reveals that patent applications in 3D printing technology have surged, growing eight times faster than the average of all other technologies in the past decade.

The European Edge

Europe isn't just dabbling in 3D printing; it's dominating. The EPO's latest data reveals that patent families in 3D printing have been growing at an average rate of 26.3% annually between 2013 and 2020. Germany is the clear leader, holding 41% of Europe's share in 3D printing patents, followed by France with 12%. It's like the European Union is the Silicon Valley of 3D printing!

The Market Dynamics

What's even more interesting is the diversity in the 3D printing market. While established engineering companies used to be the leading players, many startups are now emerging. Around a fifth of all international patent families published between 2001 and 2020 were in the health and medical sector. So, it's not just about printing cool gadgets; it's about saving lives and advancing medical science.

Questions to Ponder

How will Europe's leadership in 3D printing impact its standing in the global tech arena?

What are the potential applications of 3D printing that could revolutionise industries beyond healthcare?

As startups enter the 3D printing market, how will this affect innovation and competition?

A New Augmented Reality App Shows the Acropolis as Ancient Greeks Knew It: Time Travel at Your Fingertips

Take a breather from the high-stakes world of digital currencies and quantum computing and step into a time machine. 🕰️ No, I'm not kidding! Thanks to a new augmented reality app called Chronos, you can now experience the Acropolis in Athens as the ancient Greeks did. According to an article this time by Anca Ulea, also on Euronews, this app, supported by Greece's Culture Ministry, allows you to point your phone at the Parthenon temple and see what archaeologists believe it looked like 2,500 years ago. It's like having a DeLorean, but without the flux capacitor!

The Virtual Experience

Imagine standing in front of the Parthenon and seeing it adorned with the original Parthenon Marbles, which, by the way, are a point of contention between the British and the Greeks. The app even reveals lesser-known features, like the fact that many of the sculptures were painted in striking colours. It's like Instagram filters, but for ancient ruins!

The Bigger Picture

This isn't just an excellent app; it's part of a broader strategy to make Greece's ancient monuments more accessible. The app fits into the government's greater agenda of digital accessibility following the recent installation of ramps and anti-slip pathways. It's like the ancient world is getting a 21st-century makeover!

So, as we wrap up this week's whirlwind tour of tech innovations in the weekly Tier 1 issue, from CBDCs to augmented reality, it's clear that the future is as exciting as the past. Keep your eyes peeled and your minds open until next Thursday with the Tier 2 edition. 🌟